In the run-up to the holidays, parents, grandparents, aunts, uncles — you name it — search high and low for the trendiest toys for the children in their lives. Guaranteeing your spot as #1 gift-giver (and therefore, family member) in the eyes of the children is definitely worth the hustle! Consumer spending on toys has increased significantly in the last year, with 2021 seeing a total spend of $38.19 billion on toys in the US alone. This marks a 14% increase from the previous year and comes despite overall reduced consumer spending as a result of the pandemic. (Oberlo, 2021)

According to ChildStats.gov, in 2022, nearly 48M members of the US population are 11 years of age or younger, signaling a considerable market for toy brands. Reaching and connecting with families through advertising, however, is not child’s play. When it comes to toys, marketing involves attracting the attention of both the child and parent/guardian because, ultimately, the decision to purchase is in the hands of the person pulling the purse strings.

For brands looking to connect with audiences through CTV advertising, here are three things to remember to ensure your brand is best-in-class.

-

- Who is your audience, really?: When it comes to finding prospective toy buyers across TV, learning about their viewing patterns and behavior is key. For toy buyers, genres like reality, daytime dramas, and football top the charts. In terms of networks, CBS Sports, Telemundo, and Estrella TV make up a large chunk of their viewing time. This reinforces that a good portion i.e. nearly 1 in 5 of the toy buyer audience is Hispanic. Reaching audiences through Hispanic content and creating specific campaigns tailored to this demographic could go a long way in forming a lasting bond with potential customers. Of the LG toy buyer audience, nearly half have a household income of $100,000 or more. This proves that this segment is affluent with a high propensity to purchase. Toy buyers skew female and connecting with these audiences through female-centered messaging could help boost awareness and conversion. Partnering with media companies like LG Ad Solutions can help you unearth insights about your audience, find target viewers across TV and engage with them meaningfully.

- Know Your Competitor’s Playbook: The toy market has a lot of players, and it can be hard to make your presence felt amidst the competition. Leveraging ACR technology to understand where your competitors place TV ads can give you an upper hand in conquesting them and taking back a share of voice. Nearly half of all toy brands advertise in Kids programming. This is in line with the fact that the toy buyer audience (more than general audiences) believes that their children have a significant impact on the brands they choose. Following the kids programming genre is Comedy, Travel & Adventure and Movies. Food for thought: Does your brand have a strong presence in these genres.

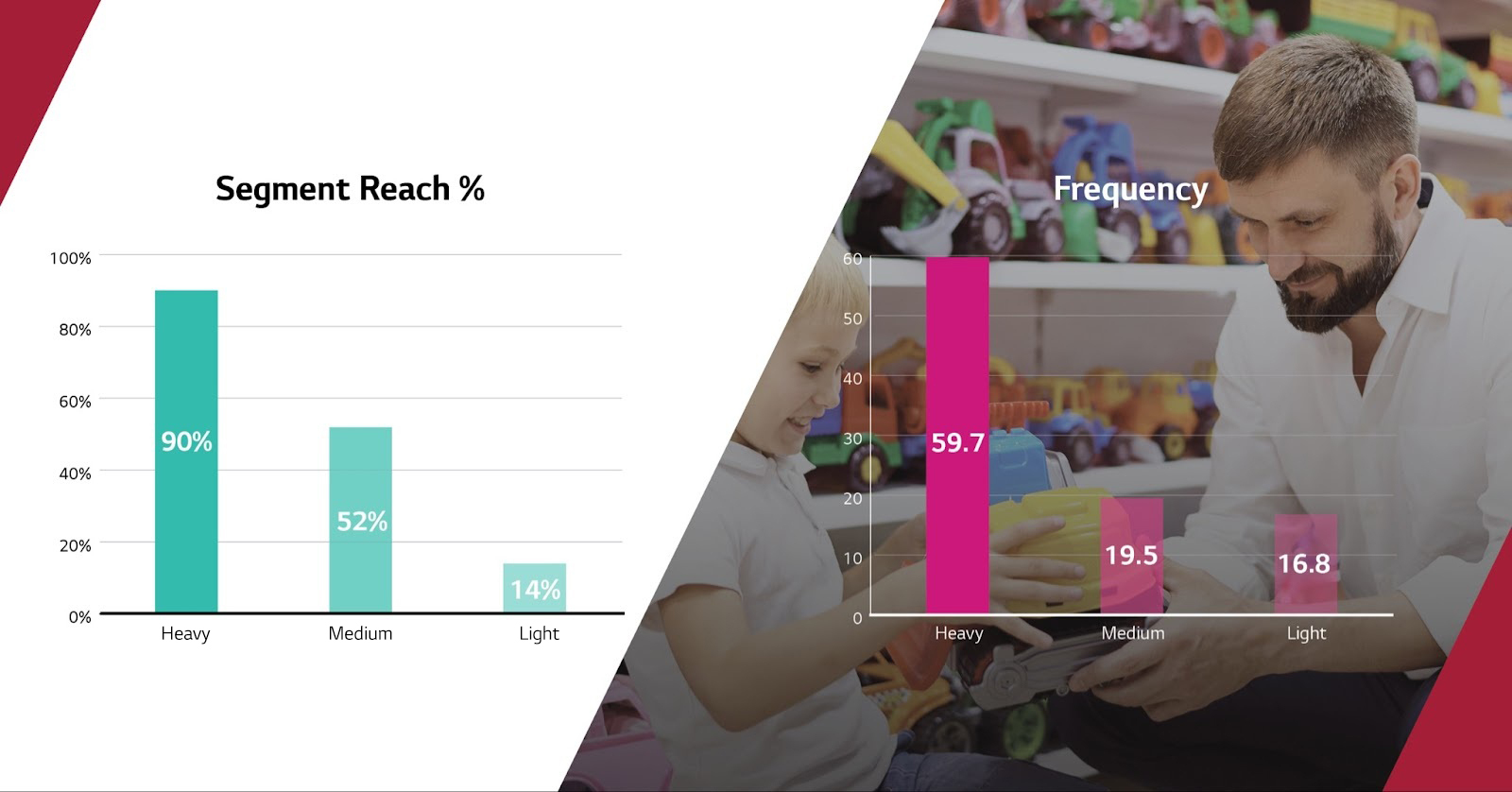

- Managing Reach & Frequency For Better ROI: As a marketer, are you worried that you are not reaching your target viewer or reaching the same viewer multiple times, without any real impact? More than half of the Toy buyer audience believes that streaming has replaced linear TV, with over two-third watching less than 7 hours of live traditional TV per week. Focusing solely on linear TV will result in a brand missing out on a large number of highly relevant streaming audiences. Additionally, with linear TV advertising, you cannot guarantee how often a viewer sees your ad. Too many times? Overexposure and ad fatigue. Too few times? No recall value. OEMs, like LG, have glass-level data and can capture what is being watched on the screen to ensure your audience firstly sees an ad and secondly, sees it an optimum number of times. For toy brands that advertise on linear TV, ads are seen by almost all heavy linear TV viewers but only 14% of light linear TV viewers. Additionally, heavy linear TV viewers are exposed to the ads ~3x more than medium or light linear TV viewers, leading to further inefficiencies.

Toy Category Linear TV Reach & Frequency

LG Ad Solutions audiences are valuable for toy brands, with one in three homes purchasing items in the toy category in 2021. Additionally, more than half of these buyers spend more than $200 on toys per year. Interested in partnering with us to place your brand in front of the right audiences in a place where they are likely to convert? Connect with us at sales@lgads.tv to enhance your campaign and move metrics.

Source: 2022 MRI/Simmons Spring Doublebase USA