If you’re wondering where to get your sports fix after the Super Bowl, fret not – March Madness is just a few short weeks away! After being canceled in 2020 and witnessing a format change in 2021 to account for the rapid spread of the covid-19 virus, the 2022 NCAA men’s tournament will go back to its customary format: a 68-team field played out across three weeks at 14 sites, starting with the First Four in Dayton, Ohio.

With a peak viewership of 18.8 million during last year’s Final Four, the March Madness audience represents a significant opportunity to reach viewers. This makes the games a battleground for advertisers, vying to get maximum eyeballs and drive return on ad spend. Last year, a week prior to tip-off, virtually all ad inventory had been sold and ad spots were more expensive than they had ever been. This year, we see this trend continuing as the games take on a more pre-pandemic appearance, with fans rooting for their teams in person from the stands and games being held in multiple locations across the country.

“While advertisers flood the airwaves with March Madness-related messaging every year, buying look-alike audiences or broad ‘sports viewer’ targets, consumer viewing habits aren’t predictable. Deterministic buying with ACR data ensures you are buying the audience and not the assumption.” – Justin Fromm, Head of Research at LG Ad Solutions

With our ACR technology and granular targeting capabilities, LG Ad Solutions can help you get the most out of your media buy during this year’s March Madness.

When deciding how to place your ad dollars, here are four things to keep in mind:

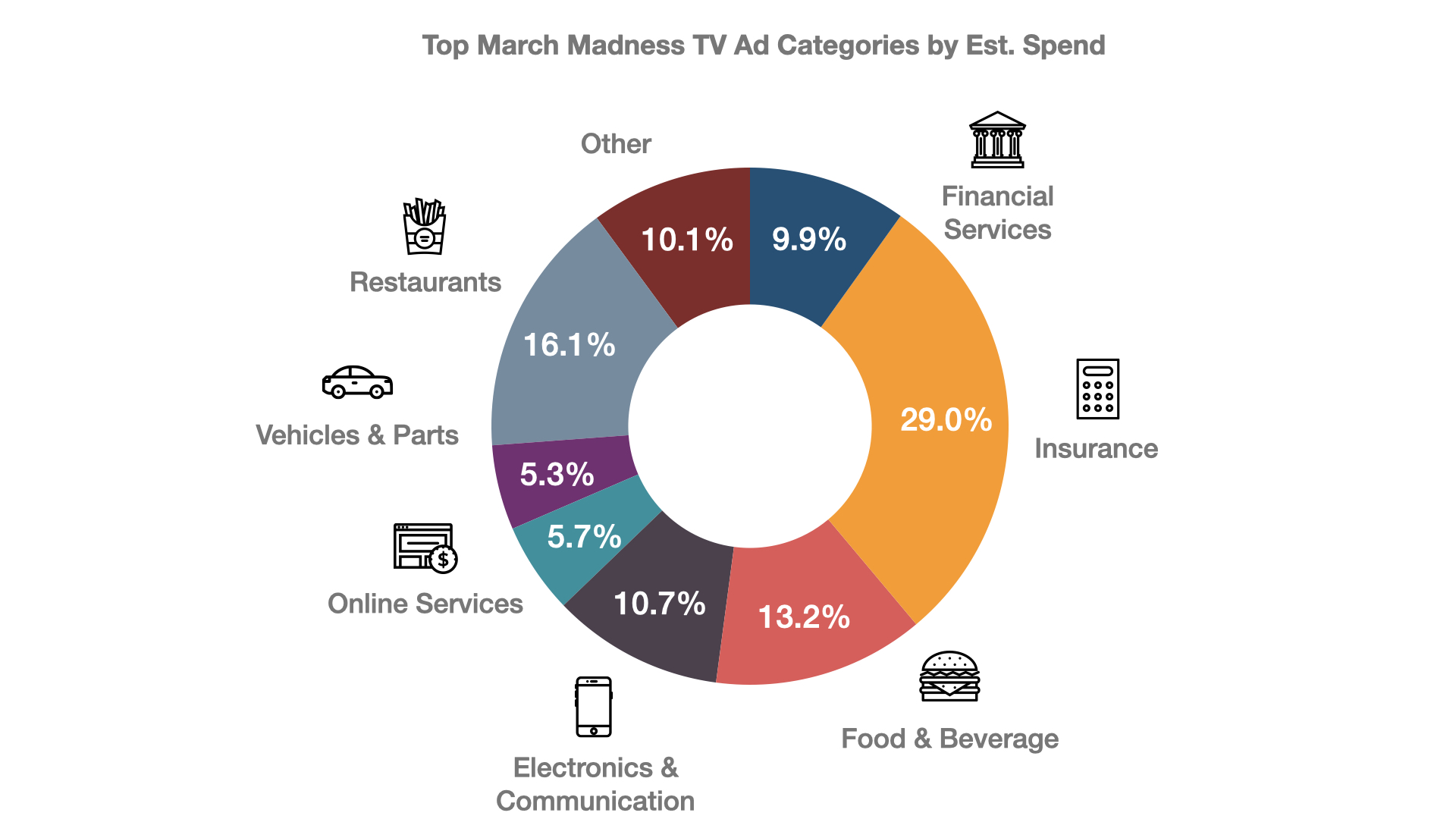

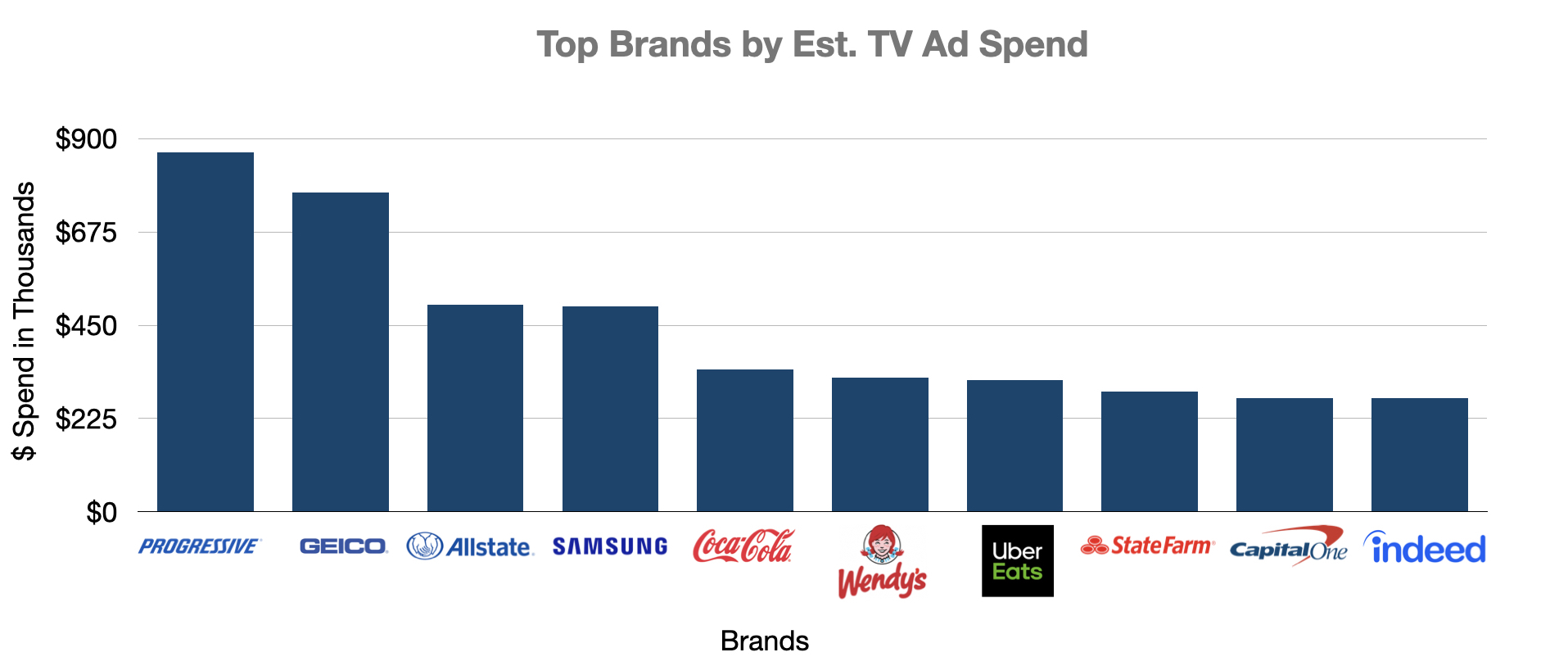

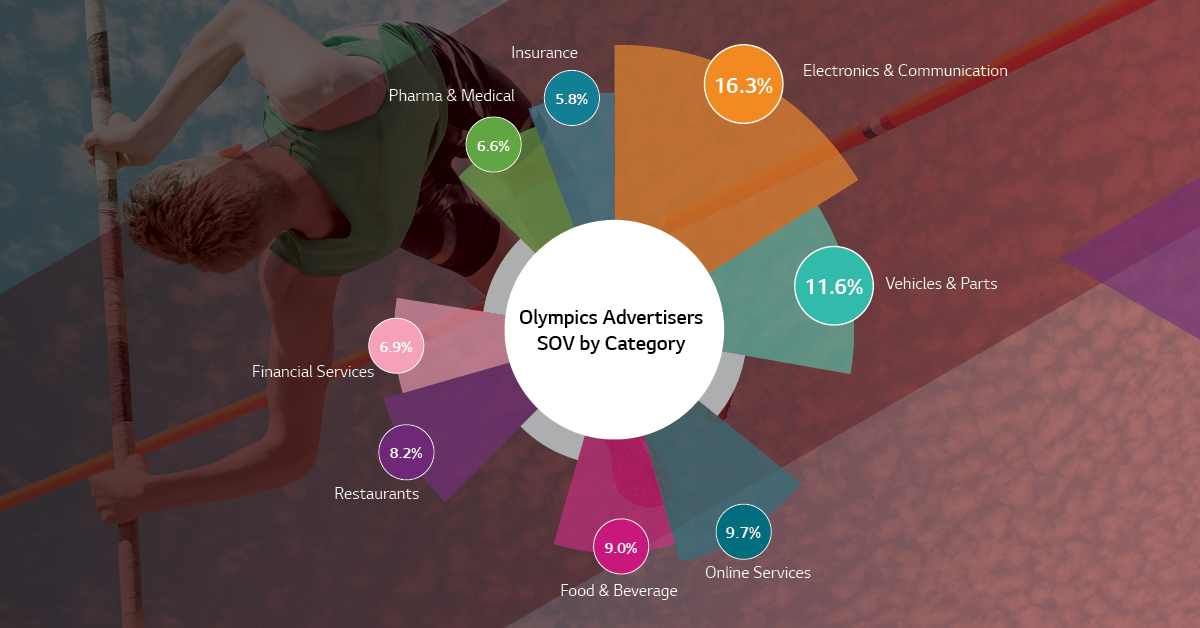

1. Know Your Competition: Food and beverage, retail and auto advertisers go big when it comes to spending on traditional linear TV during March Madness. To break through the clutter, you can double-up your efforts and look to CTV advertising to reach specific, highly relevant audiences. LG Ad Solutions native ads are a great way to take ownership of the TV and interact with your target audience at multiple touch points throughout the TV viewing experience.

2. March Madness ≠ Higher Traditional TV Viewership: March Madness does not necessarily create a windfall of incremental traditional TV viewers. Our data show that medium linear TV viewers were just as likely to spend more time on other devices as they were to increase traditional broadcast and cable viewing during March Madness last year. While linear TV witnessed an overall decline in viewership last year, OTT saw a 12% lift in time spent during March Madness — another reason to supplement your linear TV buy with OTT & CTV to improve reach and prevent duplication.

3. Cross-Platform Viewership Is On The Rise: According to MiQ, almost a quarter of March Madness viewers who watched the games live were also active on other devices. 40% of impressions generated on second screens were on a mobile phone. With our precision targeting, LG Ad Solutions can reach audiences incremental to your linear schedule, across multiple screens to reinforce your brand message and keep it top of mind for all of your consumers. Additionally, as with all live sports, viewership waxes and wanes depending on which teams qualify and how interesting the pairings are. CTV, coupled with cross-screen is the perfect last-minute strategy to employ once the brackets are set.

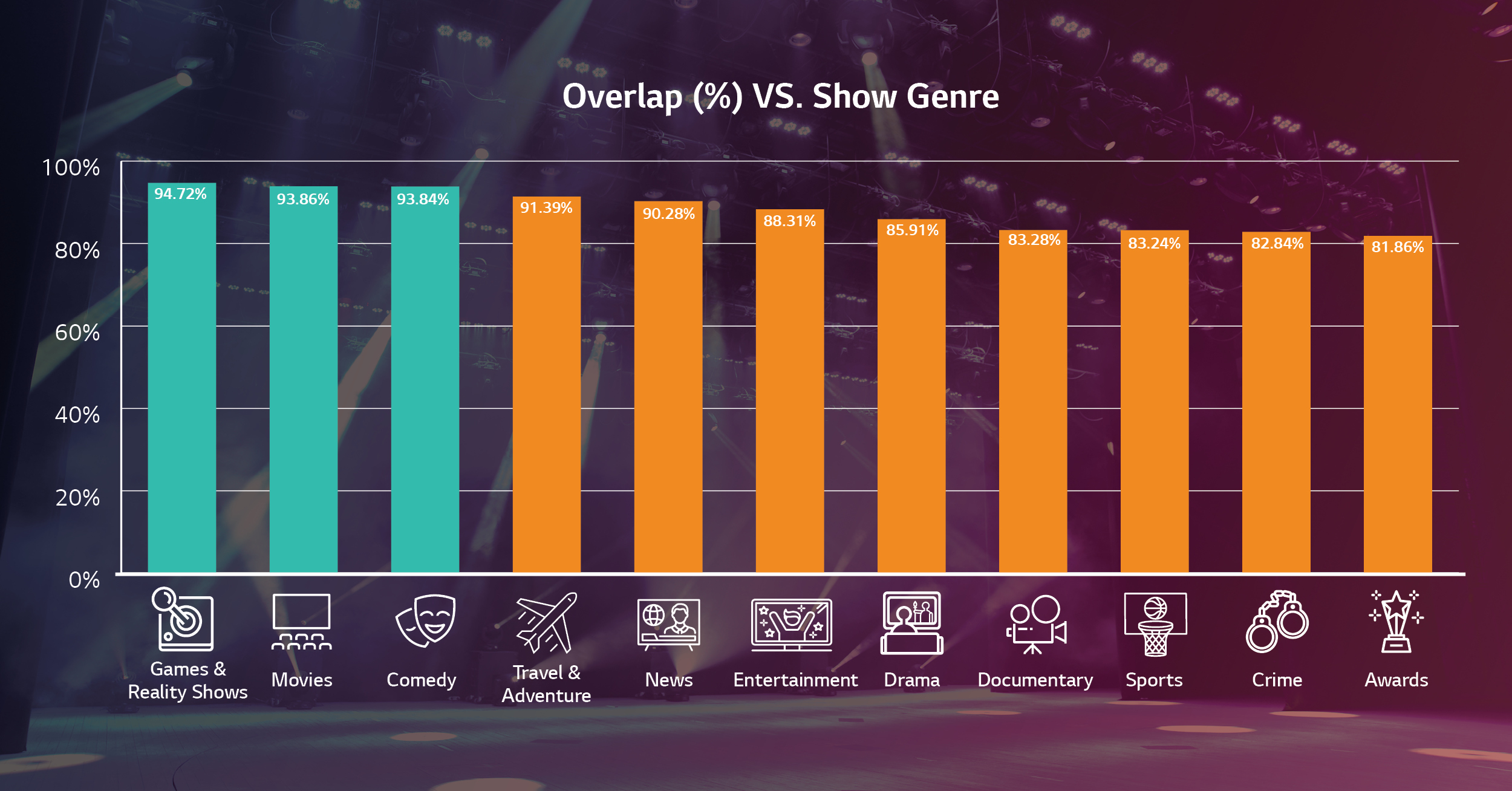

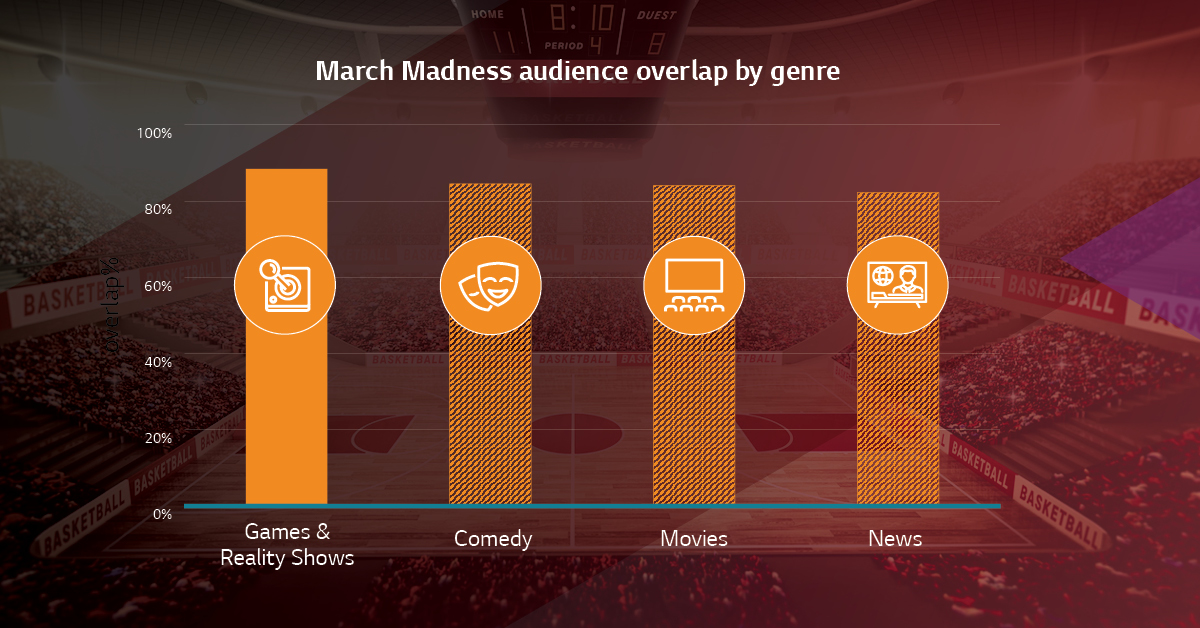

4. March Madness Viewers Have An 80%+ Overlap With Comedy, Movies and News Genres But Not Necessarily Other Basketball Games: You don’t necessarily have to reach March Madness viewers through the NCAA tournament. There are multiple (less expensive) places across TV where these audiences can be found including across comedy, movies and news genres. Don’t assume that March Madness fans are generic basketball fans. Last year, 40% of March Madness viewers did not tune-in to an NBA game in the three months preceding the tournament. LG Ad Solutions can help you pinpoint exactly where March Madness audiences are across different platforms, networks and shows. Whether it is during, before or after the season, our ACR data allows you to target viewers more effectively.

Interested in learning more? Download our March Madness Viewership Report:

Today we are thrilled to feature a guest post by DeepIntent CEO Chris Paquette, as we announce the beginning of a very exciting relationship in CTV advertising for healthcare marketers.

Today we are thrilled to feature a guest post by DeepIntent CEO Chris Paquette, as we announce the beginning of a very exciting relationship in CTV advertising for healthcare marketers.