This is the first of a five-part series highlighting how brands can understand Fall Sports viewership behavior and strategically invest in TV to reach relevant audiences

Sports fans on TV can be found across multiple platforms — streaming apps, cable TV, satellite TV, etc. When it comes to the content they consume, there is significant overlap between viewers of certain sports. This means that instead of paying exorbitant prices to reach viewers of a specific sport during tentpole events, you can reach them through other sports and related programming they watch on TV in a cost-efficient manner.

At LG Ad Solutions, we have a popular saying — buy the audience, not the assumption. When it comes to sports especially, it’s sometimes easy to paint all sports audiences with the same brush. For example, one might assume that if a TV viewer stays glued to the screen during every NCAA game, they will also be an avid NBA fan. However, our data reveals that this is not the case.

Live sports attract some of the largest TV audiences in the United States, with millions of viewers tuning in to watch the action in real-time. In 2021, approximately 57.5M US viewers watched digital live sports content at least once per month, a figure that is projected to rise to over 90M by 2025. (Source: Statista)

Major Professional Sports TV Viewers — Trends & Overlap

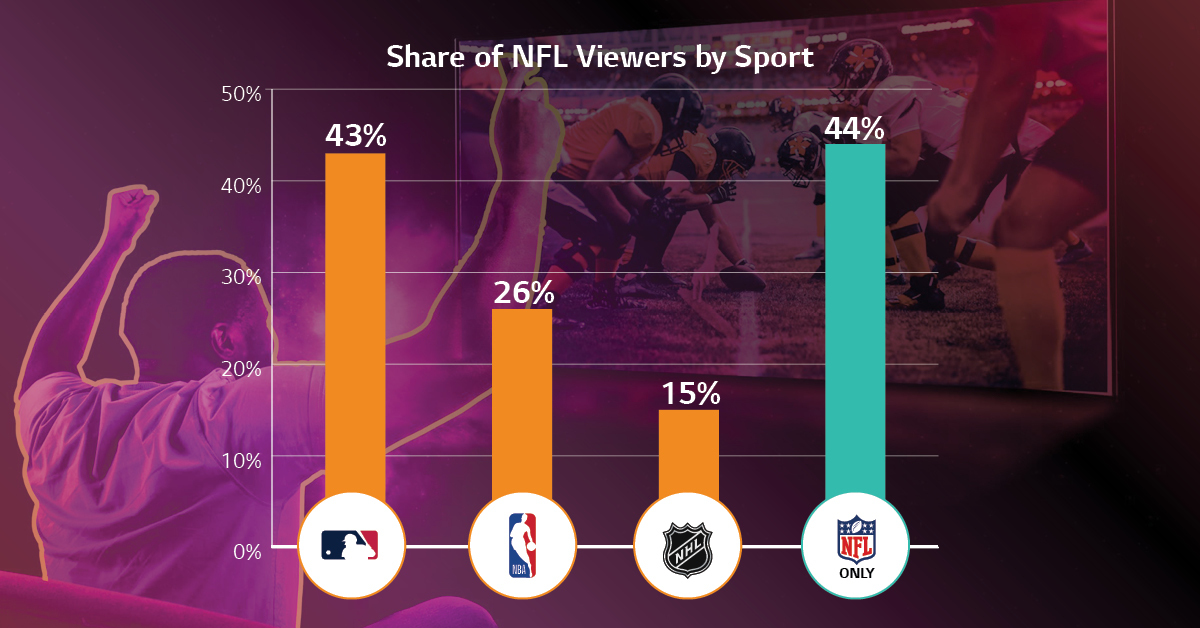

The NFL is by far the most-watched professional sport on TV in the US. A whopping 90% of major sports audiences (households that watched at least one of four sports — NFL, MLB, NBA or NHL) on LG TVs watch the NFL, while only 45% watch the MLB. NBA fans come in at 27% and NHL fans at 16%.

Of those who watch the NFL, 56% also watch the other sports. Most notably 43% can be found watching the MLB. This means that brands looking to target NFL viewers are not limited to ad spots during NFL games or NFL programming – which can be expensive and highly competitive. The same goes for NBA, MLB and NHL audiences.

Note: Data collected using Unique TV ids for NFL, NHL, NBA and MLB with a 2-minute watch-time eligibility filter.

Here’s the Kicker

To take the data one step further, we carried out an analysis to understand for how long audiences watch their sport of choice. This data indicated that NFL audiences stay on to watch NFL games for much longer than viewers of other sports. In fact, we found that within a given quarter hour, NFL audiences increased in number while audiences of all other sports in our analysis dwindled.

This analysis reiterates the fact that following the data can lead you down the yellow-brick road to accurate targeting, efficiency and ad dollars saved. Access to ACR data can help you better understand your audience and find them, regardless of where they are present across the TV landscape.

If you’re interested in learning more about how we captured this data, check out our blog on ACR technology. To find out how you can partner with us to access actionable data to fuel your media strategy, get in touch by contacting us here.