Golf and Tennis are two of the few sports considered individual, all-season sports. Both require a good swing to put the ball in motion. However, these are not the only similarities the two sports share. To dive deeper into this, we looked into what Tennis and Golf have in common in terms of TV audience viewership and advertiser trends.

We found that 1 in 4 of all LG Ad Solutions audiences watch Golf, while 1 in 5 view Tennis. Furthermore, over 80% of Tennis viewers also watch Golf, while only about half of all Golf fans watch Tennis. Brands looking to reach these audiences must be mindful of how these sports compliment and mirror each other.

Making Contact With The Audience

In terms of demographic make-up, Tennis and Golf saw similar scores. On average, 61% of audiences for both these sports have an annual income of $75,000 or more and over 70% are homeowners. This indicates Tennis and Golf fans have a higher disposable income and more buying power.

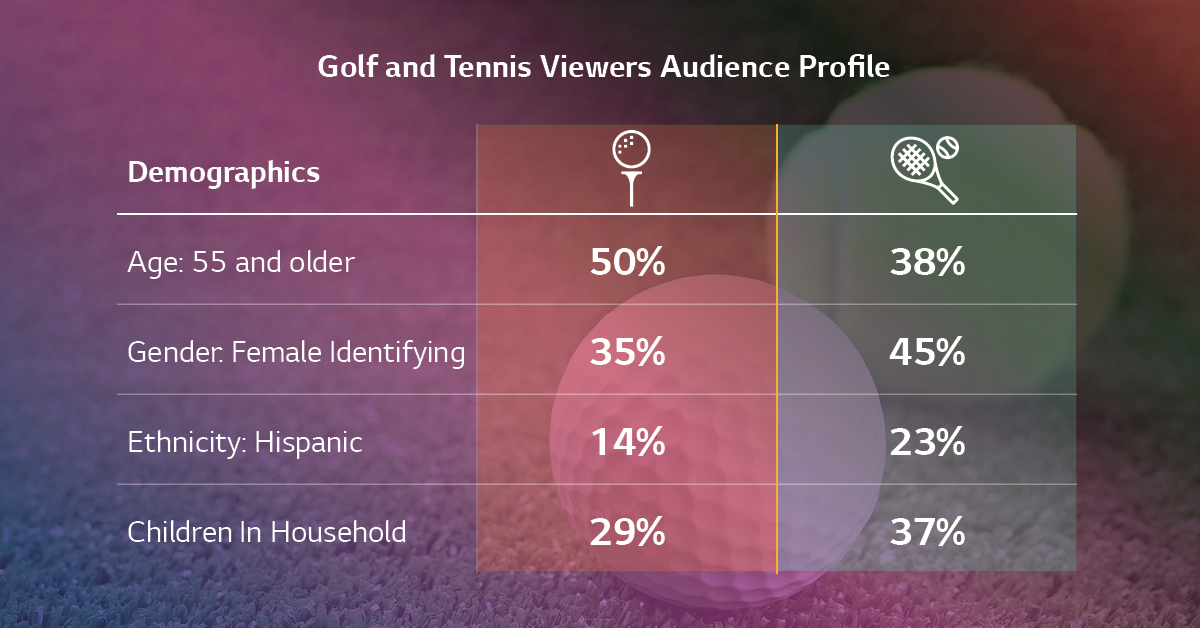

There were, however, a few differences between Golf and Tennis audiences, as highlighted below.

Eyes on the Ball

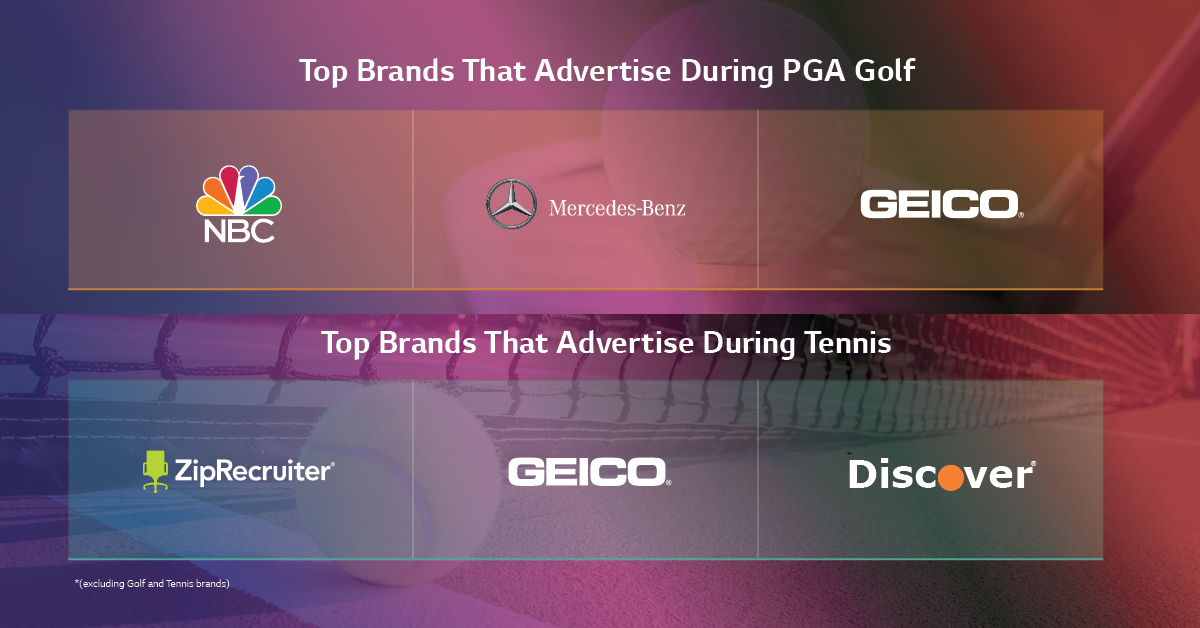

Top brands to ace the advertiser wars for PGA Golf and Tennis are as follows:

Electronics & Communication was a top category for Tennis, while Sporting Goods was a top category for PGA Golf. Vehicles & Parts, Lifestyle & Entertainment and Financial Services categories topped the chart for both sports.

Teeing up the Insights

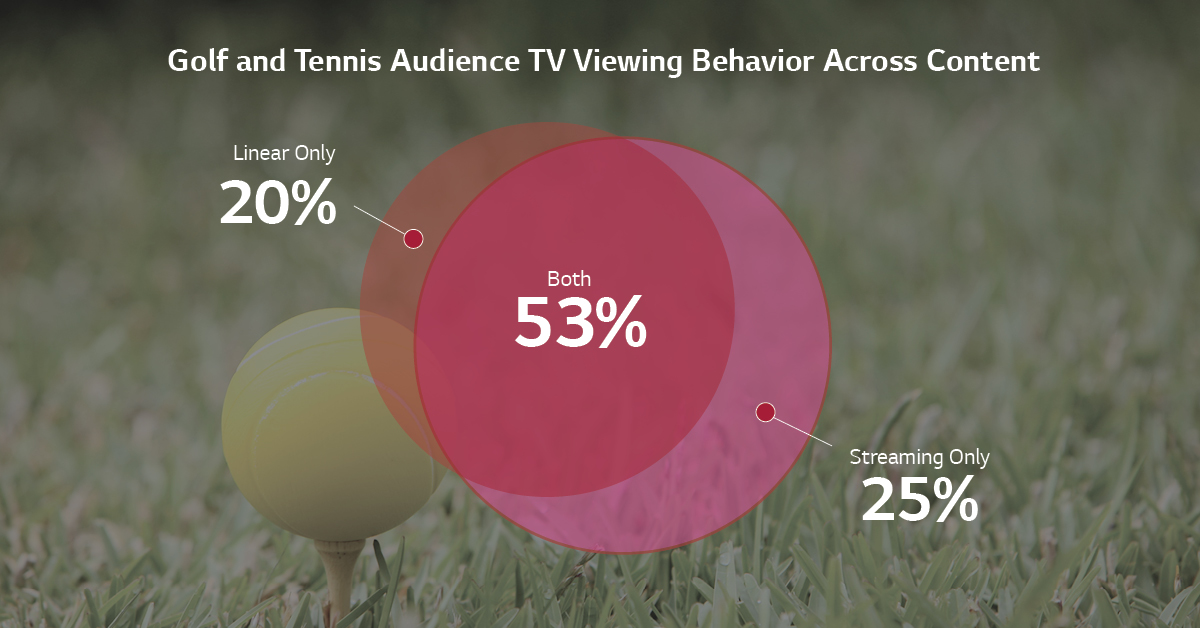

Audiences for both sports display similar results when it comes to how they watch TV. Sports, News and Games & Reality are top genres watched by both Tennis and PGA Golf fans.

More than half of both Tennis and Golf fans watch less than 7 hours of traditional TV per week and agree that they prefer watching free ad-supported video content. This makes AVOD and FAST platforms the ideal location for brands to reach these audiences. The fact that they prefer ad-supported content means that they are likely to be more receptive to and interested in tailored advertising.

These audiences can be best reached through a combination of linear and CTV to maximize impact while optimizing for frequency and spend.

Swing to Score

The high cost of in-event advertising and cluttered ad environments can deplete budgets and lower return on ad spend. With ACR data, OEMs like LG can find Tennis and Golf audiences in other programming based on their viewership patterns. We can target these same audiences on streaming TV, FAST channels and Native Ads as well as cross-device on mobile, tablet and desktop. This allows marketers to reach audiences where they are likely to convert and steal a share of voice from competitors.

Grand Slam or Hole-In-One? Either Way, we have your Back

Whether you’re trying to connect with Tennis fans or Golf viewers, the crux of every campaign lies in having access to data. At LG Ad Solutions, our ACR data gives us access to 30M+ US and 130M+ global addressable smart TVs. This data, coupled with campaign data from the thousands of campaigns we’ve run, allows us to reach the right audiences at the right time, and improve conversion. Partner with us to make the most of your media budget. For more information, get in touch at info@lgads.tv or on our contact page .

Note: All analyses carried out are based on national ad airings only

For PGA Golf, games considered include PGA Tour Golf, Women’s Golf, LPGA Tour Golf, PGA Tour Champions Golf & 2020 Ryder Cup games from September 16- Dec 31, 2021

For Tennis, matches considered include 2021 Wimbledon Championships, 2021 U.S. Open Tennis, 2022 Australian Open Tennis and 2022 Roland-Garros Tennis (French Open)